The S&P/ASX 100 (XTO) Index is comprised of Australia’s large and mid-cap equities.

The index contains the 100 largest ASX listed stocks with the cut-off being a market capitalisation of ~$1.7 billion (AUD). Constituents account for ~73% (September 2023) of Australia’s sharemarket capitalisation.

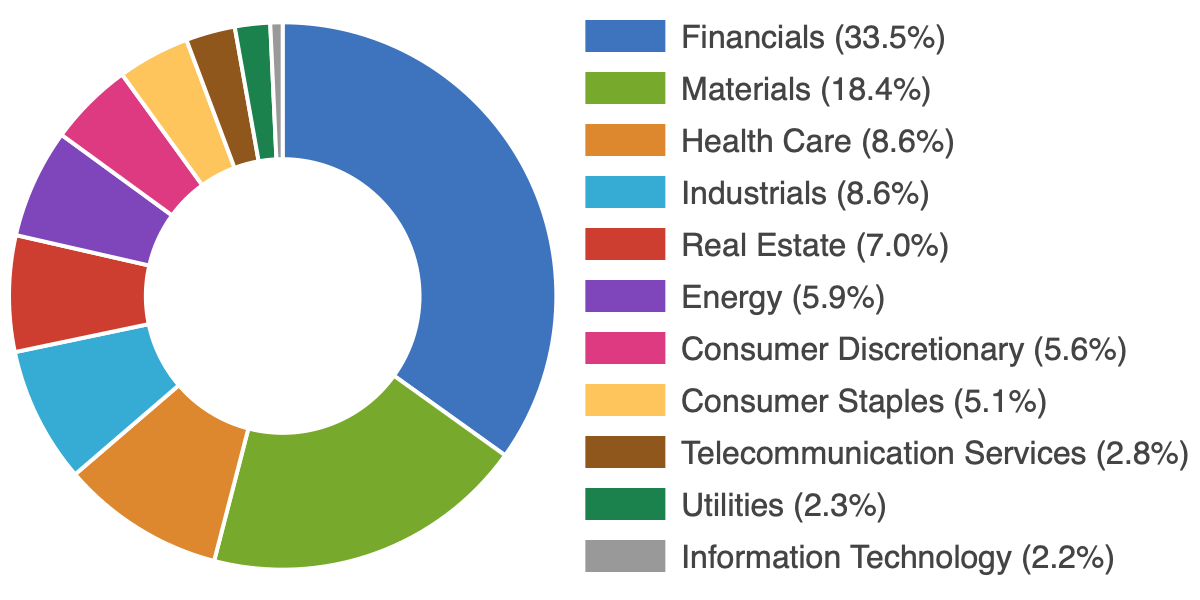

The ASX 100 is well diversified with all 11 GICS Sectors represented. Financials and Materials (which includes resources) dominate the index, accounting for circa 30% and 24% of market-cap respectively (September 2023).

There’s currently one Exchange Traded Fund (ETF) that tracks the performance of the index: ANZ ETFS S&P/ASX 100 ETF (ZOZI).

IMPORTANT

IMPORTANTASX100list.com doesn’t provide share price data.

The best website is Market Index.

They have current ASX share prices, company charts and announcements, dividend data, directors’ transactions and broker consensus.

How are ASX 100 companies selected?

Constituents are selected by a committee from Standard & Poor’s (S&P) and the Australian Securities Exchange (ASX).

All companies listed on the Australian Securities Exchange (ASX) are ranked by market capitalisation. Exchange traded funds (ETFs) and Listed Investment Companies (LICs) are ignored. The top 100 ASX stocks that meet minimum volume and investment benchmarks then become eligible for inclusion in the index.

Rebalances are conducted quarterly in March, June, September and December. If a significant event occurs (e.g. delisting, merger, etc.) an intra-quarter rebalance may be conducted. A minimum of two business days’ notice is given to the market.

Skip to the ASX 100: Sector Breakdown | PE & Yield | ETF

Skip to the ASX 100: Sector Breakdown | PE & Yield | ETF

ASX 100 List (28 April 2021)

Click here for the current Share Prices (and Stock Charts)

The 100 largest companies by market capitalisation (includes ETFs & LICs) and not S&P constituents.

| Code | Company |

|---|---|

| A2M | The a2 Milk Company Ltd |

| AFI | Australian Foundation Investment Company Ltd |

| AGL | AGL Energy Ltd |

| AIA | Auckland International Airport Ltd |

| ALD | Ampol Ltd |

| ALL | Aristocrat Leisure Ltd |

| ALQ | Als Ltd |

| ALX | Atlas Arteria |

| AMC | Amcor Plc |

| ANN | Ansell Ltd |

| ANZ | Australia and New Zealand Banking Group Ltd |

| APA | APA Group |

| APT | Afterpay Ltd |

| ARG | Argo Investments Ltd |

| AST | Ausnet Services Ltd |

| ASX | ASX Ltd |

| AWC | Alumina Ltd |

| AZJ | Aurizon Holdings Ltd |

| BEN | Bendigo and Adelaide Bank Ltd |

| BHP | BHP Group Ltd |

| BLD | Boral Ltd |

| BOQ | Bank of Queensland Ltd |

| BSL | Bluescope Steel Ltd |

| BXB | Brambles Ltd |

| CBA | Commonwealth Bank of Australia |

| CCL | Coca-Cola Amatil Ltd |

| CHC | Charter Hall Group |

| CIM | Cimic Group Ltd |

| COH | Cochlear Ltd |

| COL | Coles Group Ltd |

| CPU | Computershare Ltd |

| CSL | CSL Ltd |

| CWN | Crown Resorts Ltd |

| CWY | Cleanaway Waste Management Ltd |

| DMP | Domino's PIZZA Enterprises Ltd |

| DXS | Dexus |

| EVN | Evolution Mining Ltd |

| FBU | Fletcher Building Ltd |

| FMG | Fortescue Metals Group Ltd |

| FPH | Fisher & Paykel Healthcare Corporation Ltd |

| GMG | Goodman Group |

| GPT | GPT Group |

| HVN | Harvey Norman Holdings Ltd |

| IAG | Insurance Australia Group Ltd |

| IEL | Idp Education Ltd |

| IGO | IGO Ltd |

| IPL | Incitec Pivot Ltd |

| JBH | JB Hi-Fi Ltd |

| JHX | James Hardie Industries Plc |

| LLC | Lendlease Group |

| MCY | Mercury NZ Ltd |

| MEZ | Meridian Energy Ltd |

| MFG | Magellan Financial Group Ltd |

| MGOC | Magellan Global Fund (Open Class) (Managed Fund) |

| MGR | Mirvac Group |

| MIN | Mineral Resources Ltd |

| MPL | Medibank Private Ltd |

| MQG | Macquarie Group Ltd |

| NAB | National Australia Bank Ltd |

| NCM | Newcrest Mining Ltd |

| NST | Northern Star Resources Ltd |

| NXT | NEXTDC Ltd |

| ORG | Origin Energy Ltd |

| ORI | Orica Ltd |

| OSH | Oil Search Ltd |

| OZL | OZ Minerals Ltd |

| PMGOLD | Gold |

| QAN | Qantas Airways Ltd |

| QBE | QBE Insurance Group Ltd |

| QUB | QUBE Holdings Ltd |

| REA | REA Group Ltd |

| REH | Reece Ltd |

| RHC | Ramsay Health Care Ltd |

| RIO | RIO Tinto Ltd |

| RMD | Resmed Inc |

| S32 | SOUTH32 Ltd |

| SCG | Scentre Group |

| SEK | Seek Ltd |

| SGP | Stockland |

| SHL | Sonic Healthcare Ltd |

| SOL | Washington H Soul Pattinson & Company Ltd |

| SPK | Spark New Zealand Ltd |

| STO | Santos Ltd |

| SUN | Suncorp Group Ltd |

| SVW | Seven Group Holdings Ltd |

| SYD | Sydney Airport |

| TAH | Tabcorp Holdings Ltd |

| TCL | Transurban Group |

| TLS | Telstra Corporation Ltd |

| TPG | TPG Telecom Ltd |

| TWE | Treasury Wine Estates Ltd |

| VAS | Vanguard Australian Shares INDEX ETF |

| VCX | Vicinity Centres |

| WBC | Westpac Banking Corporation |

| WES | Wesfarmers Ltd |

| WOR | Worley Ltd |

| WOW | Woolworths Group Ltd |

| WPL | Woodside Petroleum Ltd |

| WTC | Wisetech Global Ltd |

| XRO | Xero Ltd |

Sector breakdown

All S&P/ASX Indices use the Global Industry Classification Standard (GICS) to categorise constituents according to their principal business activity.

The S&P/ASX 100 Index contains all 11 GICS Sectors.

Data updated: 1 March 2019

PE Ratio & Dividend Yield

Fundamental data for the S&P/ASX 100 Index is weight-adjusted by market capitalisation. Companies with zero or negative values are ignored.

No fundamental data is available for this index.

Exchange Traded Fund (ETF)

ETFs are managed funds that track a benchmark. They trade on the ASX like ordinary shares using their ticker code. The goal of an index fund is to replicate the performance of the underlying index, less fees and expenses.

As at 10 October 2016, the ANZ ETFS S&P/ASX 100 ETF (ZOZI) is the only ETF that tracks the performance of the S&P/ASX 100 Index.

| ANZ ETFS S&P/ASX 100 ETF (ZOZI) | |

|---|---|

| Manager: | ANZ |

| Inception: | 12 June 2015 |

| Mgmt Fee: | 0.24% |

| Fact Sheet: | Link |